TRX Price Prediction: Can Nasdaq Momentum Push TRX to $0.40?

#TRX

- Technical Strength: Price above 20-day MA with MACD turning positive

- Catalyst: Nasdaq listing boosts institutional interest

- Risk: TVL drop and extreme greed sentiment may cause pullbacks

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

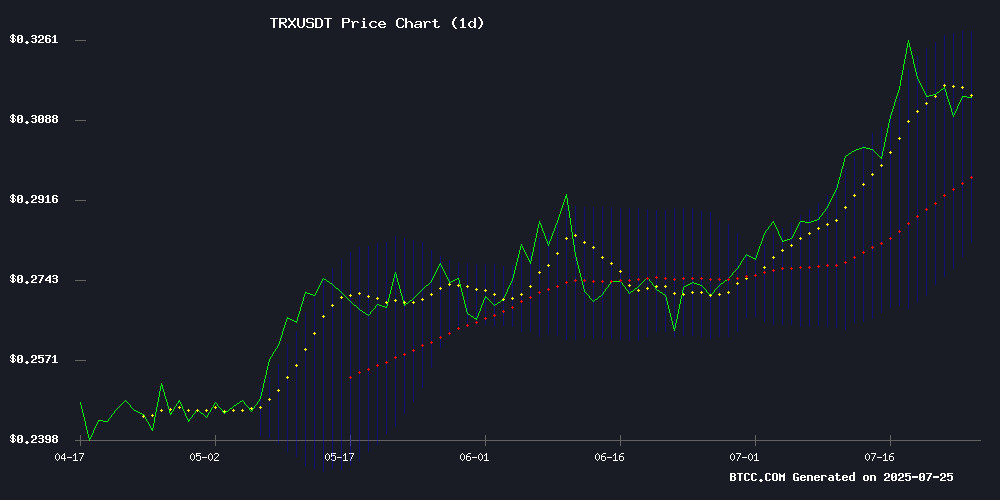

TRX is currently trading at $0.3132, above its 20-day moving average of $0.305185, indicating a bullish trend. The MACD shows a slight positive crossover with a value of 0.000475, suggesting potential upward momentum. Bollinger Bands reveal that the price is closer to the upper band at $0.327862, which could act as a near-term resistance level. 'The technical setup favors bulls, with key support at the 20-day MA,' says BTCC financial analyst Mia.

TRX Market Sentiment: Nasdaq Debut Fuels Optimism

TRON's recent Nasdaq debut via reverse merger has sparked bullish sentiment, with headlines suggesting a potential rally to $0.40. Despite a 0.42% gain post-listing, the TVL drop warrants caution. 'The Nasdaq bell ceremony has provided strong visibility, but traders should watch for profit-taking near $0.327 resistance,' notes BTCC's Mia. Extreme greed in crypto sentiment could amplify TRX's volatility.

Factors Influencing TRX’s Price

Justin Sun’s Tron Inc. Goes Public on Nasdaq via Reverse Merger

Tron Inc., the largest public holder of TRX tokens, has made its Nasdaq debut through an unconventional reverse merger with SRM Entertainment, a toy manufacturer supplying major brands like Disney and Universal. The move marks a significant milestone for cryptocurrency's integration into traditional finance.

Justin Sun rang the opening bell, calling the listing "a dream 15 years in the making" and declaring it the start of cryptocurrency's era on Wall Street. The newly public entity holds 365 million TRX tokens worth approximately $115 million.

Market reaction was immediate, with TRX trading volume surging 36.33% to $1.83 billion within 24 hours of the listing. The company plans to operate with a hybrid crypto treasury model, offering investors exposure to both digital assets and physical products.

Tron Coin Flips Cardano as Justin Sun Rings Nasdaq Bell, TRX Price to $0.40?

TRON coin surpassed Cardano in market capitalization to claim the ninth-largest crypto asset spot after Tron Inc and Justin Sun rang the Nasdaq opening bell in New York. The event marked another milestone for Sun, who has been actively involved with the TRUMP family's crypto ventures, including investments in TRUMP meme coins and ties to World Liberty Financial.

Despite a broader market downturn, TRX's price decline was less severe than ADA's 8% drop, solidifying its position with a market cap above $29 billion. The network's 2025 high reflects growing activity, bolstered by stablecoin issuers favoring TRON for settlements. USDT's supply on TRON has exceeded $80 billion, capturing over 50% of the circulating stablecoin market.

Regulatory tailwinds, including the GENIUS Act and the SEC dropping its fraud investigation into Sun, further underscore TRON's momentum. The U.S. government's push to leverage stablecoins for dollar dominance aligns with TRON's expanding role in the ecosystem.

TRON (TRX) Gains 0.42% Amid Nasdaq Debut Despite TVL Drop

TRON's TRX rose 0.42% to $0.31 as its parent company, Tron Inc., celebrated a Nasdaq listing through a $100 million reverse merger with SRM Entertainment. The milestone lends institutional credibility to the blockchain entertainment platform, countering recent concerns about its ecosystem health.

Behind the market optimism lies a $136 million decline in Total Value Locked (TVL), signaling potential liquidity outflows. This divergence between corporate achievement and on-chain metrics creates a complex narrative for TRX investors.

The token demonstrates unusual stability during the current altcoin market correction, with its RSI at 60.59 suggesting neutral momentum and room for upward movement. TRON's ability to maintain price levels while peers decline highlights its growing market resilience.

TRON (TRX) Price Prediction: Can Strong Fundamentals Drive a Breakout Above $0.56?

TRON's improving fundamentals are lending credibility to its recent price action. The project has reduced transaction fees by over 70% and made a notable appearance on the Nasdaq, signaling growing institutional interest. TRON Incorporation, now holding the largest public treasury of TRX, is set to ring the opening bell at Nasdaq, further bridging the gap between crypto and traditional finance.

On the technical front, TRX price is approaching a key resistance level near $0.35, maintaining a clear uptrend. A confirmed breakout with volume could pave the way for a move toward $0.44-$0.45. The weekly chart structure remains bullish, with higher lows and sustained support above key moving averages.

Ruvi AI (RUVI) Emerges as Strong Contender Against Tron (TRX) for High Returns

Tron (TRX) once captivated investors with its decentralized content-sharing platform, delivering significant gains during its ascent. Yet, the crypto market's evolution has shifted focus to projects with robust fundamentals and wider utility. Ruvi AI (RUVI), a blockchain-powered AI initiative, is now drawing attention as a potential outperformer, with analysts predicting it could achieve six-figure returns faster and with lower capital requirements than TRX.

Security and transparency form the bedrock of Ruvi AI's appeal. The project recently underwent a rigorous audit by CyberScope, a leading blockchain security firm, which validated the integrity of its smart contracts. Further bolstering confidence, Ruvi AI has secured a partnership with WEEX Exchange, ensuring immediate liquidity post-presale—a critical factor for investor trust in today's cautious climate.

Why DeSoc Could Dominate The Crypto Space In 2025 Over Tron And Litecoin

Tron and Litecoin, long-standing pillars of the crypto ecosystem, face a formidable challenger in DeSoc. Powered by the $SOCS token, DeSoc is redefining blockchain utility with built-in monetization, governance, and cross-platform integration. While Tron has established itself as a developer-friendly blockchain with consistent DApp activity, its growth appears stagnant compared to DeSoc's innovative approach to social interoperability and creator economics.

TRX's performance remains a topic of debate among analysts. Despite reaching an all-time high of $0.44 in December 2024, the token struggles to break the $1 barrier. Some predict a rebound to $0.40, while more optimistic voices envision $2. Yet, Tron's legacy status may work against it as DeSoc gains traction with next-generation solutions.

TRON (TRX) Holds Steady Above $0.31 Following Nasdaq Bell Ceremony

TRX maintains its position at $0.31, buoyed by institutional confidence after TRON Inc.'s historic Nasdaq Opening Bell ceremony. The event marks a pivotal moment in the company's rebranding journey, now positioning itself as a blockchain-focused entity with substantial TRX holdings.

The Relative Strength Index (RSI) at 62.63 indicates neutral momentum with bullish potential. This follows earlier gains when TRX surged to $0.32 on the initial rebranding news, showcasing strong market sentiment.

TRON Inc.'s Nasdaq appearance underscores its commitment to merging traditional finance with blockchain innovation, providing a solid foundation for TRX's price stability. Institutional validation from such milestones continues to reinforce key technical support levels.

$TRUMP Token Launches on TRON Network via LayerZero Integration

TRON DAO has deployed the $TRUMP token on its high-throughput blockchain, leveraging LayerZero's OFT standard for cross-chain interoperability. The move taps into TRON's $20 billion daily transfer volume and 321 million accounts, positioning the token for DeFi, payments, and community use cases.

LayerZero's infrastructure enables seamless omnichain transfers while preserving $TRUMP's unified supply. This technical integration reflects TRON's strategic push into real-world asset tokenization, combining its low-fee architecture with cross-chain liquidity from Stargate Finance.

Crypto Sentiment Hits Extreme Greed: TRON and Dogecoin Poised for Gains

Market sentiment in the cryptocurrency sector has surged into extreme greed, fueling speculation about which digital assets stand to benefit most. TRON (TRX) and Dogecoin (DOGE) emerge as notable contenders, with both showing strong momentum and potential for further upside.

TRON trades between $0.29 and $0.33, having climbed 13% over the past month and 21% in six months. The coin hovers near its 10-day moving average, signaling stability. A breakout above resistance at $0.35 could trigger an 18% rally, with support firmly established at $0.27.

Dogecoin maintains its position between $0.21 and $0.31, testing resistance at $0.34. The meme coin's resilience suggests room for growth if bullish conditions persist. Both assets exemplify the market's risk-on appetite as traders chase high-beta opportunities.

How High Will TRX Price Go?

TRX shows strong potential for upward movement, with technical indicators and Nasdaq-driven optimism aligning. Key levels to watch:

| Level | Price (USDT) | Significance |

|---|---|---|

| Resistance | 0.327862 | Upper Bollinger Band |

| Target | 0.400000 | Psychological round number |

| Support | 0.305185 | 20-day Moving Average |

'A close above $0.327 could accelerate gains toward $0.40,' says Mia, while cautioning about potential volatility from extreme greed sentiment.